NFI token is the native utility token of the NEXFI launchpad platform, powering the entire ecosystem. NFI tokens are built on Casper Network (CSPR).

NFI token plays an important role in operating the NEXFI ecosystem, and also brings profits to holders and rights for long-term development.

As soon as you stake, you start earning NFI, and those earnings contribute directly toward your allocation power in the system. With the maximum cap in place, it means allocations are fairly and broadly distributed, while large holders are still rewarded relative to their stake. As a result, we have a balanced economy that rewards both large and small holders.

In summary, NFI stakers are rewarded in four ways:

Although this website may be linked to other websites, we are not directly or indirectly involving any approval, association, sponsorship, endorsement or affiliation with any linked website, unless specifically indicated in this document. We are not responsible for examining or evaluating, and we do not guarantee the offers of any company or individual or the content of their websites. We do not assume any responsibility or obligation for the actions, products, services and content of other third parties. You should carefully review the legal statements and other conditions of use of any website that you access through a link from this website. Your link to any other website outside the site is at your own risk.

When using NEXFI launchpad, users are required to pay a small fee for each transaction successfully. This fee is paid using the native NFI token.

A 2% fee is deducted from each new stake deposited on the platform.

100% of this fee is immediately redistributed to all other stakers, in proportion to their NFI staked (excluding the user who is paying the fee).

Bear in mind, after paying your deposit fee, you will now earn on the fees of those staking after you. Your earnings will be based on the size of your stake relative to other stakes in the platform.

Over time, this 2% (and more) will be returned through accumulated platform fees and rewards.

Mana Points are unit of NEXFI that define your benefits on the platform. MP cannot be purchased or traded, but are earned across the platform.

When you stake your NFI for a predetermined duration, you will receive additional distribution opportunities in the form of MP, which can be used for any IDO. There are 4 blocking conditions that you can participate in:

The minimum stake is 1 NFI.

There is no maximum you can stake. You cannot unstake NFI until your chosen stake expires (3,6,12 months).

For Stake freely

The 15% figure can be customized according to the situation later.

Should you decide to claim an allocation, a fee of 2% fee of your allocation will be collected in NFI and also distributed to NFI stakers. For example, a $100 allocation would exact a $2 fee paid in NFI. This fee not only promotes more thoughtful participation, but supports smaller stakers and individuals who can’t, or don’t want to, participate in sales.

These fees ensure a properly incentivized network and allow for some unique characteristics of the launchpad:

Even with a maximum per person allocation in place, there is still a reason to accumulate hold and stake NFI.

You don’t need to KYC or participate in sales to earn from the platform.

As NEXFI grows larger, so do NFI staker’s holdings.

Over time, even small stakers will earn enough in the network to become more meaningful participants — meaning more relative stake and allocation power. NFI from the whales who claim allocations is redistributed into the hands of everyone else, leveling the playing for the entire system.

*Fee amounts will be monitored over time. They are not set in stone and can be adjusted, in either direction, if needed.

To promote decentralized community governance for the network, NFI token holders may propose and vote on governance proposals to determine features and/or parameters of the NEXFI and its products. By participating in the platform’s governance model, users can commit NFI tokens to vote on new features and changes to various protocol parameters throughout the NFI crypto network.

For the avoidance of doubt, the right to vote is restricted solely to voting on features of the NEXFI; the right to vote does not entitle NFI token holders to vote on the operation and management of the Company, its affiliates, or their assets or the disposition of such assets to token holders, and does not constitute any equity interest in any of these entities. The arrangement is not intended to be any form of joint venture or partnership.

NFI holders will enjoy Incentives from NEXFI, or events from NEXFI’s partners, such as airdrops from projects that will launch on NEXFI.

NFI tokens will be used to create a “self-sustainable economy” through network fee collection, which will be redistributed as an incentive to active contributors in the ecosystem or dedicated to product development and future ecosystem growth.

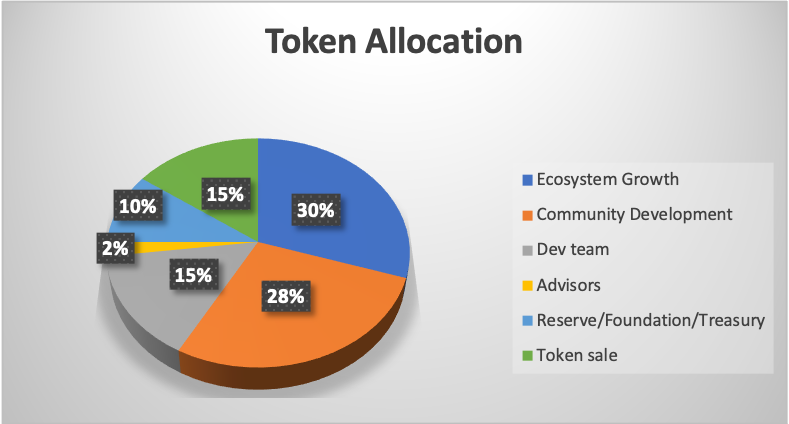

Specification:

Ecosystem Growth: 3 years vesting, 50% release at 2 week after TGE (Token Generation Event), linear unlock starting from the 2nd year

Community Development: 3 years vesting, 50% release at TGE, linear unlock starting from the 2nd year

Team: 3 years vesting, 1 year cliff, linear unlock starting from the 2nd year.

Private Sale: 1,5 years vesting, 1 year cliff, linear unlock starting from the 2nd year.

Reserve/Foundation/Treasury: 3 years vesting, 30% release at 3 months after TGE, linear unlock starting from the 2nd year.

Seed Sale: 2 years vesting, 1 year cliff, linear unlock starting from the 2nd year.

Advisors: 2 years vesting, 1 year cliff, linear unlock starting from the 2nd year.